Avenixio Review 2025 – Trading Risks, Regulation Status & Safer Alternatives

Quick Overview

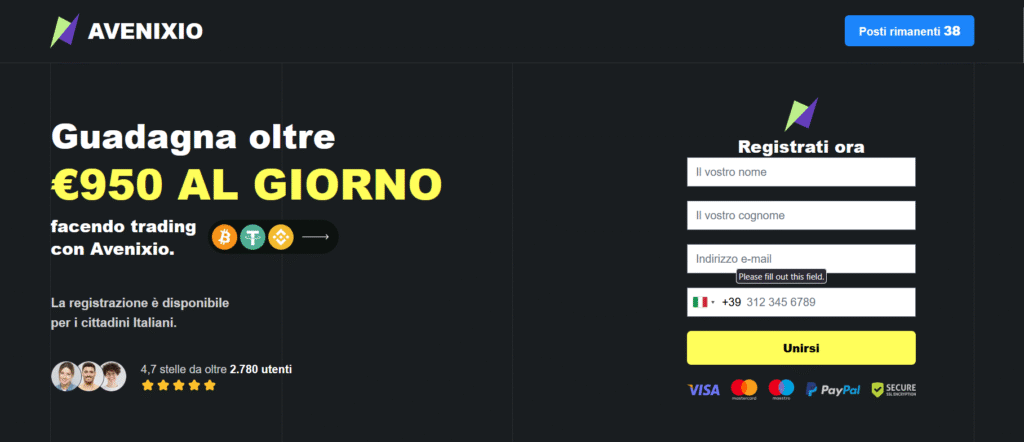

This Avenixio review offers a concise analysis of the platform’s trading environment, regulatory visibility, and risk factors. Avenixio advertises access to multiple financial markets, including crypto and CFDs. However, traders should evaluate regulatory compliance and withdrawal reliability before committing funds.

This review focuses strictly on risk awareness and safer alternatives.

What Traders Should Know About Avenixio

Avenixio typically promotes:

Multi-asset trading access

Leverage-based positions

Account manager “support”

An easy-to-use online platform

However, the platform does not publicly display verifiable, top-tier financial regulation such as FCA, ASIC, or CySEC oversight.

This lack of regulatory clarity increases risk in areas such as:

Fund custody

Withdrawal autonomy

Dispute resolution

For many traders, this alone is a deal-breaker.

Common Risk Signals Traders Watch For

Platforms with similar structures often come with the following concerns:

Withdrawal delays or blocked withdrawals

Additional fees required before releasing profits

High-pressure deposit requests from “managers”

Ambiguity around the company’s location and owners

These patterns do not automatically define every user’s experience — but they are major industry red flags.

Why Many Traders Prefer a Private Copy Trading Network Instead

To avoid platform uncertainty, more traders are joining private, invitation-only copy trading groups that offer:

User-controlled capital (never platform-held)

Public, verified trading performance

Professionally managed risk

No withdrawal restrictions whatsoever

Selective access for quality control

This is ideal for individuals who value:

Capital safety

Consistent risk-managed results

Transparent strategy execution

A safer structural alternative to offshore platforms

Avenixio vs Private Copy Trading Access

| Factor | Avenixio | Private Copy Trading Group |

|---|---|---|

| Regulation Transparency | Unclear | Fully transparent strategy history |

| Control of Funds | Platform-controlled | User-controlled |

| Withdrawal Access | Often uncertain | Direct broker access |

| Risk Management | Platform-dependent | Professional traders |

| Access | Public | Invite-only |

Final Verdict

Based on available public information, this Avenixio review indicates that the platform falls into a high-risk category due to unclear licensing, offshore exposure, and patterns commonly associated with withdrawal limitations.

While some users may not encounter issues, safety-focused traders typically prefer environments with:

Full control of their capital

Transparent execution

Verified historical performance

Private copy trading networks offer exactly this structure — with far fewer platform risks.

Join the Private Copy Trading Group (Exclusive Access)

Our private copy trading group is not open to the public. Membership is limited and selectively approved to protect performance, risk management, and capital stability.

This group is ideal for traders seeking:

Verified returns

Controlled exposure

Capital security

Discreet participation

A safer alternative to unregulated platforms

👉 To request access:

Go directly to the Contact page and submit your request for private copy trading access.

All applications are individually reviewed.

Source & Reference Links

- Avenixio Website:

https://avenixio.com - FCA (UK Regulation Check):

https://register.fca.org.uk - ASIC (Australia Regulator Search):

https://connectonline.asic.gov.au - ICANN WHOIS Domain Lookup:

https://lookup.icann.org - ScamAdviser Public Risk Scan:

https://www.scamadviser.com